There is everything going for it this year. Big Capital is heavily on the warpath with more cash than ever looking at older, smaller and tertiary property with as much effort as they do with “A” product. Occupiers are armed with low tax rates and incentives for new plant, equipment, and improvements. Technologists are advancing innovation to increase cash flows with robotics, automation, ecommerce and sharing. At the top, the Developer-in Chief is intent on making commercial real estate and U.S. Industry the biggest winners in the economy.

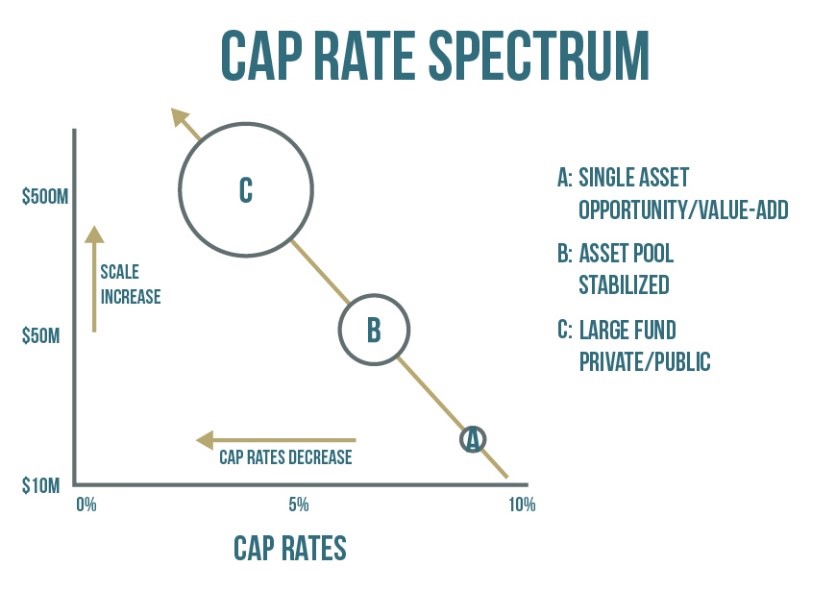

What does it look like on the street? Stressed conditions with very little space, surging prices, and nothing but cash. Now that Occupiers have been ignited with favorable tax treatment, even more capital will be coming in. The biggest shortcoming is very little new product will be created. Instead Big Capital is looking for anything with yield and upside promise wherever it might be. When it comes to older, infill industrial, Big Capital will clash with Occupiers. There will be more big investment buys in the march to scale.

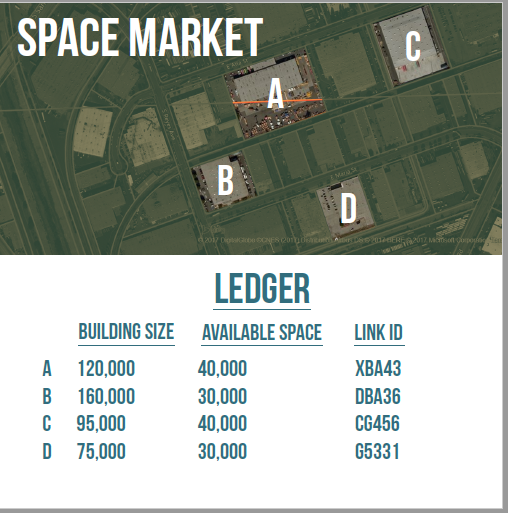

From the brokerage perspective, it makes turning over new product primary. Without Xcelligent, one of the main listing services that filed Chapter 7 before the Holidays, it will return us to a period of less data consolidation and more “open” and “off-market” listings. The gap of market information will greatly reward those who can find product. There will be less emphasis on traditional agency work and more on trading and transacting. It’s where we see payoff in digital operations.

Under this type of market action, Occupiers will continue to be disadvantaged. Conventional ways of facility planning will need to give way to “market opportunities”. Big Capital has so many tools on hand that conditions that deter Occupiers like timing, tenants, and environmental are simply adjusted in the price at closing. I see the return of a separate “User Price”, not seen since interest rates hit bottom and even a “development for sale” business.

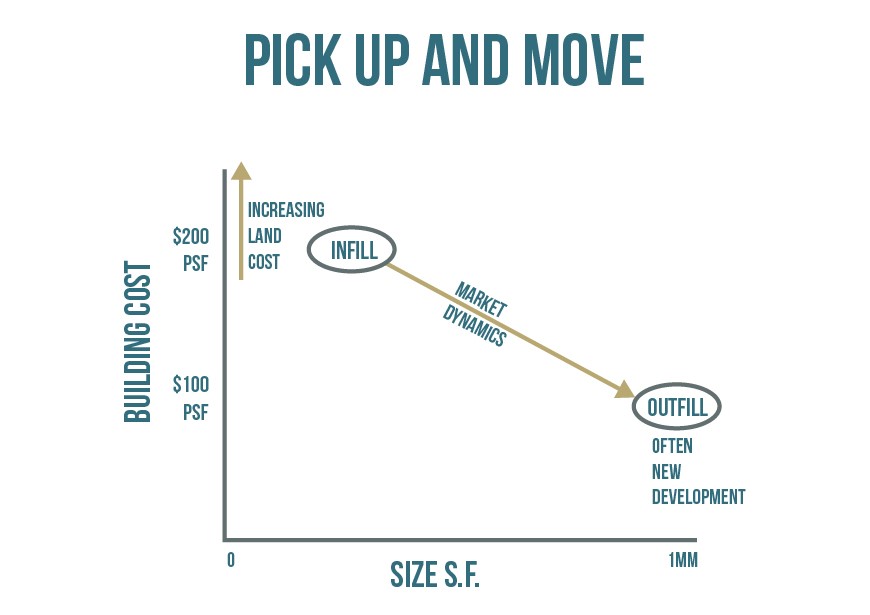

While competition for assets will be intense, in a much different sense, Big Capital and Occupiers are natural allies. Without income there is no deal. Many large Occupiers regularly leverage their occupancy into favorable terms. Under the right circumstances, the few merchant builders left will sweeten the pot because a User-in-Tow is a meaningful advantage. Occupiers on the fence will finally “pick up and move”. They will leave California, avoid state taxes, expense a new development, and sell their old infill building for a big profit. Occupiers going asset-lite with contract production and ecommerce can also gain equity wherever their goods reside. Even if you don’t take title solely in your own name, many partnerships will be created where Occupiers can benefit from Big Capital and new tax laws.

As the year begins, the sharing revolution continues to amaze. I see all sorts of unconventional space sharing in Los Angeles that are based on trust and IP-enabled security cameras. Landlords can earn more rent and Occupiers can control their space needs precisely. So far, most sharing arrangements are created organically through word of mouth and among neighbors. There is absolutely no market or exchange for shared spaces, but it might be the fastest growing part of the industrial real estate business.

Gardena, Los Angeles, Inland Empire, and across the U.S.

On Market/Off Market

Big Investors/Small Investors/Developers/Occupiers/Property Owners

Let’s make a deal in 2018.

Thank you and Especially to My Loyal Clients,

Jim Klein, SIOR

jimklein@kleincom.com

310-451-8121