The industrial real estate business keeps changing. I pay close attention to trends because they lead to deals. These are a few observations for end of 2017.

Lack of space continues. Partly because there is no more infill land to develop but also many occupants don’t fully mark their space to be market. If they charged themselves market price, space would be used more efficiently and, excess put up for rent.

There is pervasive institutional growth down to smaller and older buildings. While this means there is more professionally managed space better suited to tenant needs, these properties seldom come back for sale and reduce space for Occupiers to purchase.

Both the influence of corporate real estate managers and their corporate real estate holdings have diminished. The long-term trend to liquidate real estate assets is mostly complete. Once the dominant owner of industrial real estate, corporates now supply the cash flow that buoys development and ownership. European corporates favor purchasing but more for production facilities.

Cash deals are dominant. Except for SBA, I see very few financed deals. If buyers are borrowing money they do so on their own without any contingencies in the contract. If you can’t close quickly with cash, you’re not in the running.

Business expansion is moderate and growing. There are a few big winners in Last Mile and ecommerce but they undermine mid-level distributors and producers. Just what we saw happen on Main Street and now see in Retail, we will see in suppliers.

The market, particularly leasing, has become more transparent with listing services and many qualified brokers. Many sale deals however are done in the off-market, through relationships and by a lot of searching.

Surging rents come to an end. Many rents have doubled over current lease terms. But that trend cannot continue. Once you have hit the surge expect more moderate increases. The strategy is to find those properties that haven’t surged but there are fewer and fewer.

Industrial Occupiers

Our most profitable area is the work we do for Occupiers in advising, searching, and buying on their behalf. We see the same pattern in many metros that we try to replicate. Corporates and Owner/Users leave the urban cores for more modern facilities closer to the outskirts. The math on the move generally works out to 50% more space for the same money. The old space is then backfilled with Last Mile or Creative. Large consumer products have mostly completed the transition but now it’s the turn of mid-size companies when they are looking to grow.

Moving from Los Angeles, my primary market, to the Inland Empire is a regular occurrence. Bay Area firms will go to Central Valley. Close-in NYC industrial users located in Bushwick or South Bronx will move to Jersey City/Newark or south to 9A and even Philly. In Dallas you can leave the center and go to Alliance and parts north or South where there is a robust land development business. Chicago has the oldest industrial in the core. I always thought South Chicago, with a lot of manufacturing history, was a natural location. But Chicagoans see expansion on the South Side unlikely as compared to Romeoville or South Wisconsin. These dynamics are similar in every market.

My very general knowledge of U.S. industrial is due to experience and data we collect, but for in depth, on the ground knowledge, in every U.S. (and European) market, I only rely on local SIORs. Even if you and I never do a deal, my best advice, always use a SIOR for office and industrial.

One large shortcoming is the small amount of buildings available to purchase for Occupiers. This condition holds true across the U.S. Owning your own building was a standard way to build net worth but those opportunities are limited today. Most new developments are done in concert with financial partners who plan to keep the properties long term. The linkage between institutional capital and developers expanded after the 2007 Financial Crisis, when developers got tired of taking personal risk and institutions wanted secure return. The relationship is still strong and dominant. Institutional ownership overrides the demand for owner/user buildings.

A lot of our Occupier clients want to buy straight out. In other cases, some Occupiers don’t always want to go 100% but would like to make an investment in the property where they plan to reside for the next ten years. In those cases, they will allow us to leverage their occupancy and take in private investors as partners. It’s quite an opportunity to have even 75% leased because it assures the ability to raise funds. The developer sells for the same price or better than he would get from an institution. The investor earns at minimum a market return with a tenant at the start. The Occupier pays market rent and earns a preferred return or other incentives for their leasehold.

Gardena

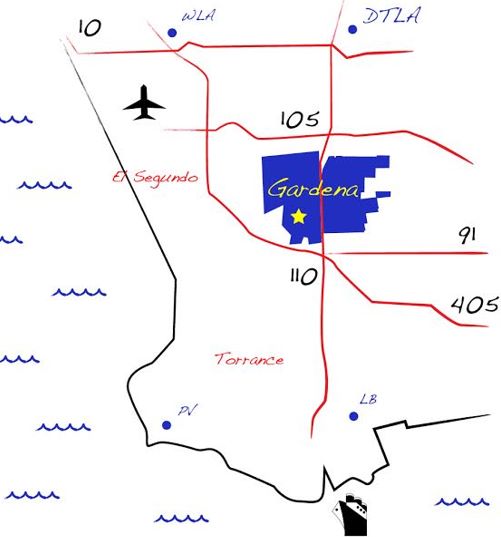

After comparing industrial in many parts of the U.S. it’s hard to beat Gardena, particularly for smaller investors. Gardena is located at the center of the three most important transportation hubs in Los Angeles which are all connected by multiple freeways – 15 minutes from LAX, Downtown Los Angeles, and the Ports. Many of the best consumer markets are within 30 minutes in Orange County and West L.A. Gardena is a large market and when greater South Bay is included, it’s bigger than most cities.

Opportunities are few. I may see one or two good buys per quarter, but because of superior location, all these buildings are readily adaptable to Last Mile and Creative. Many buildings are still in the hands of business owners ready to retire. Others are in Family Trusts where they are clearly minimizing expensive improvements for lower rents as they maintain a comfortable generational cash flow. These are the situations institutional investors are seeking and explains why many come to visit. Size, they learn, is the biggest obstacle. Because buildings run small in Gardena, it’s difficult to justify the time big investors need to spend. This is a clear opportunity for smaller investors.

Smaller investors have another advantage. In a small building market, simple improvements can increase the rent way beyond their cost and boost yield significantly. Thoughtfully designed space divisions. Separating yard from building. Patios, Gardens, wifi, new bathrooms and showers. New windows, light, and skylights. These are some of the minor improvements that don’t cost a lot, but add value in a personal and creative way that tenants prefer.

Rents in Gardena are hitting $10.00 per year Net. At a 5% return, depending on conditions, $200 per foot is market price in many average cases for a sound investment with long term credit tenants. Sounds astonishing until you realize returns over time are positive but not spectacular. Over 35 years prices are up about 4.7% annually in nominal terms while inflation averaged 2.7% annually over the period. Cap rates at 5% are compared to 20-Year Treasuries at 2.6%. Adding real appreciation and yield together, Gardena industrial produced a positive 5% combined annual real rate over the past 35 years unlevered. About the same as the S&P 500 over roughly the same period. Since many of my investor/developer customers demand more profits, they will take opportunistic risks by buying right, redeveloping, and operating shrewdly.

There are risks from a meltdown when activity freezes. I have seen it happen three or four times in my career. There are many explanations but all share a lot in common. Capital freezes up, tenants start going out, and prices drop. Building owners with a lot of equity and little leverage can normally survive by reducing rent. In cases with a lot of debt, recessions normally outlast reserves and result in restructuring. Luckily, in Gardena, buildings are small enough with a lot of equity, the effects of a downturn are muted.

I’ll be heading to Chicago next week for SIOR. I’m the founding Chair of the Industrial Group so we get to examine many industrial markets and properties close up. Because so many major markets have been bought up, we’ll be examining secondary and tertiary industrial markets. This is will be a double session led by the MIT Center of Real Estate. Not only are businesses interested in these towns and regions for overlooked human resources, but they are the pockets that have not seen the rent surges. We will also be examining Capital Markets and ways to structure deals for our personal accounts. I’ll have a short report when I return.

Thank you to my clients and customers for all your support.

(If you want to be removed from this list, please respond and we will delete your immediately)

Nice summary, Mr Klein.