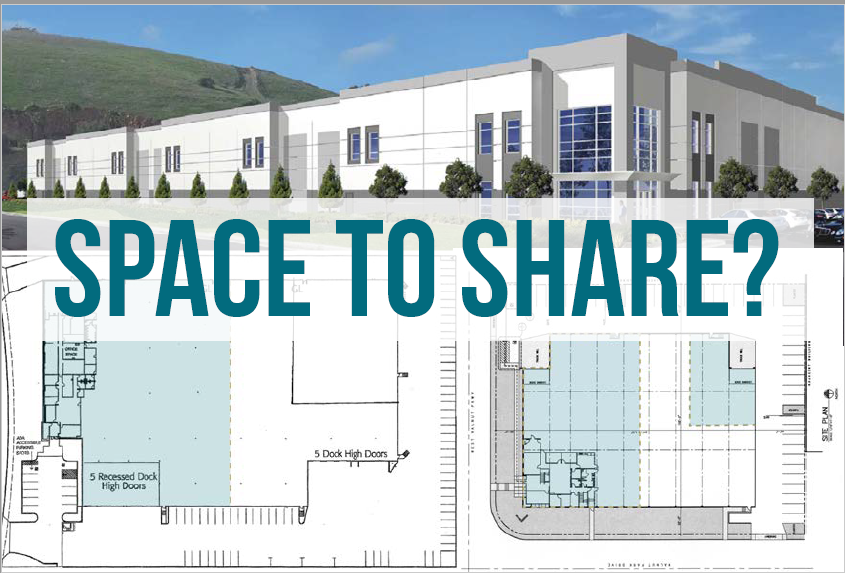

Space Sharing is a new version of a very old concept. An owner or occupant can put excess space up for rent and let tenants make flexible space commitments. Technology eases the sharing process with on-demand electronic exchanges and connected tools for measurement, accounting and security. Other variations of the same concept are Co-Working and Space as a Service (SaaS). All share the same goal of dividing space and time into smaller increments that can be charged out at flexible and generally, higher rates. It’s as simple as posting the Sharing Space and finding tenants to fill it.

There are already many common examples of Space Sharing in industries as diverse as third-party logistics, moving and storage, studio and sound stages, WeWork, Amazon Warehouses, Food Halls, Pop-ups, and plain, old neighborliness. What’s new are the technologies that allows individual landlords and occupants to profit from Space Sharing without incurring any extraordinary costs.

Conventional leases occur over a fixed amount of area for a fixed period under a lease document. For instance, a 5-year lease for 100,000 square feet. Leases like these were developed because of the collateral they provide for a lender to step in the shoes of a defaulting Landlord. Until the lending market evolves into full acceptance of Sharing, Sharing Rents will serve as substantial generator of additional rents.

The primary factor is tight market conditions which allows for premium pricing to be charged for excess space. While overall vacancy rates are historically low, underutilized space is poorly measured and is uncalculated. Realization of this phenomena is causing landlords and occupiers to capitalize on their excess space by sharing it out either directly or through sharing platforms.

Here in Gardena, we have been introducing Space Sharing to customers who can use the service. Not only is Sharing a logical way to fill excess space, but Sharing Rents normally exceed contract rents so there is a profit to earn. Smart real estate operators realize this can trigger sublease provisions, but because of the flexible nature of Sharing, it operates in a gray area of your lease document. In addition to sharing the space, sharing the profits is a very topical legal issue.

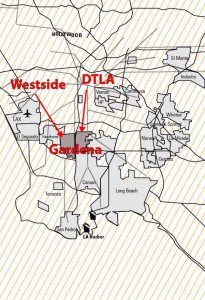

One version of Sharing is hyper-local and is a common way to handle overflow. Next door is ideal and around the block can be too far. In addition, certain locations are ideal for regional access. For instance, because of Gardena’s extensive freeway network and proximity to major economic and upscale residential centers, it is the perfect location to serve all of Los Angeles especially in the growing area of ecommerce. Many tenants have an “asset-light” model and prefer to retain flexible lease commitments.

Most individual Brokers find Sharing unprofitable because the spaces tend to be small and short term. Innovative platforms are being created that allow parties to meet organically and structure their own arrangement. For instance, I’m compensated for the introduction and the personal real estate experience I bring. We use social networking, direct “farming”, and custom software programming to fill the space. But for most customers, methodology is secondary. The critical point is you can put excess space to work and generate excess rents.

Thanks for Subscribing,

Jim Klein, SIOR

310-493-0053

jimklein@kleincom.com

www.IndustryLands.com