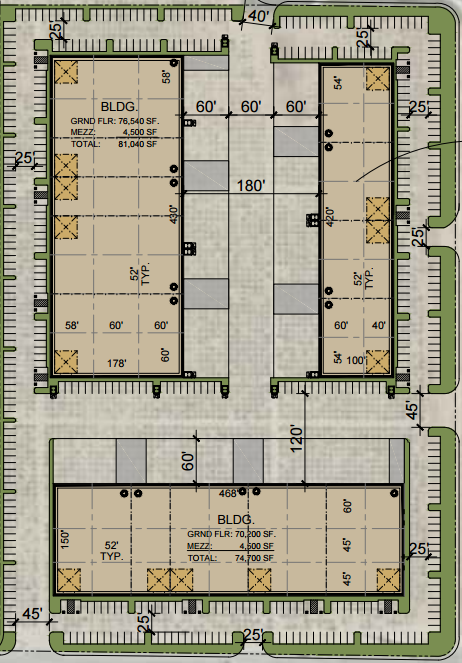

Inland Empire Development Deal – 180,000 SF Total

More and more, typical industrial development in the Inland Empire will look like this. Instead of one large warehouse with lots of truck doors, cities will require smaller buildings so not to conflict with nearby residential communities. This planning protocol significantly increases the costs for the developer but it creates opportunities for Occupiers who wouldn’t ordinarily find a building in smaller sizes to purchase.

Continue reading “Inland Empire Development Deal – 180,000 SF Total”