Introduction

This is clearly an exciting market, finally. Land and buildings are trading robustly in all corners of US Industrial.. There are three reasons to explain the activity – moderate growth; dearth of recent, new construction; and lots of institutional finance. There is virtually no product available, especially for newer generation buildings. As far as capital, it’s a wave of money that wants to be invested in industrial.

Across the U.S., even in markets that have long been dormant, it’s a full throttled land grab. Land owners who had long ago surrendered to the idea their land’s worth almost nothing, are seeing offers many times more than they thought. There are buyers who are acting irrationally with purchase prices being unsupported by rents. Proven developers don’t act this way, but they have to compete with impulsive buyers. This can lead to the type of chaos that occurs when fundamentals become ungrounded. For now, it’s “game on”.

Recovery from the Great Recessions has led to a new era of industrial real estate investment philosophy. Corporate real estate is gone, not because of the Great Recession, they sold off their real estate decades earlier. The influence of corporate real estate managers in industrial real estate is greatly reduced. There are no old plants to tear down and even the office of corporate real estate is gone. There’s no one left to court because decision making is diffused. While leases are the essential part of the business, the days of public corporate ownership of vast tracts of plants and factories, and the power that came with it, is gone.

Another mortality during the recession was the entrepreneur developer. They were generally self-made stalwarts of the local community that borrowed from local commercial banks. For the most part, that breed of developer, which represented a large amount of new space, has not returned to the game. A few of the entrepreneurial developers have been able to attract institutional finance. However most have been caught short because they lack access to capital and performance from small and mid-size companies is only at the cusp of reviving.

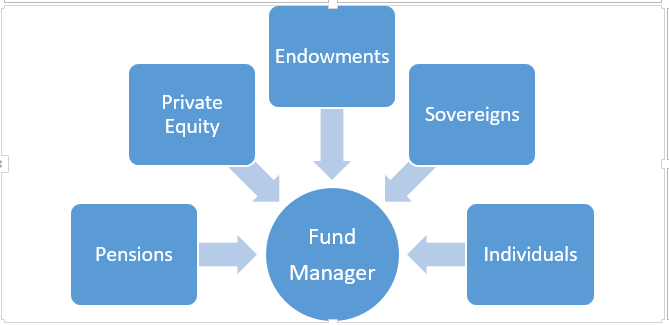

Fund Manager

In the place of corporate real estate and the local developers, come the Fund Managers. Funds have enormous resources and they are tasked with finding deals in the world of industrial real estate. They have a strong institutional and financial leaning. Fund Managers are joined by like-minded colleagues from insurance companies, REITS and developers. Logistics is the underpinning to keep buildings rented. The dominant thinking is movement of goods, strategic locations, and capital deployment. To make an extreme leap, there are examples of real estate juggernauts that combine an occupier, real estate entity, and capital source to create an investment vehicle of REIT like scale. Different than under the Fortune 500 aegis, financialization drives industrial real estate today because of its excellent investment features of income, appreciation and diversity.

Not every buyer is a fund manager but it’s a discipline everyone shares. The influence of the Fund Manager is pervasive for two main reasons. In many cases, they will be the eventual building owner and will often serve as a development capital partner. The Fund Manager thinks in formulaic terms geared to daily capital markets. Every line item has a precise place on the spreadsheet and must fall within a narrow band. There is no mystery to reaching the numbers except to have years of experience and training.

Landowners rarely see this picture. They mostly focus on two things, the final sale price and the ability of the developer to perform. Conversely, from the Fund Manager point of view, land is simply one item on a spreadsheet that needs to balance against market rents. By working backward from a fully stabilized cap rate, land prices at any stage of development has an exact value. The entire proforma is basic mathematics with some risk factors added to adjust for market surprises. Most professional developers will generally come to the same conclusions about the value of land at any given time. Most land sellers lack the concrete tools other than offers they receive.

Land Sellers Are Out Matched

While land is the essential ingredient to any development, Land Sellers are generally the most inexperienced of all. Normally, their professional lives are in completely separate fields. They are unware of the intricacies of finance, build-to-suit, and exit cap rates and have no idea how their property contributes to the ultimate investment. Land Sellers receive knowledge from neighbors, brokers and other informal sources. Unfortunately, these sources can be unreliable because of different conditions and a variety of unknowns. In contrast, the Fund Manager is armed with tons of data, contacts, billions of dollars in transactions, and the intellectual training, formal or informal, to buy and develop to today’s financial hurdles. Land Sellers lack those resources. While proper advisors and consultants exist, those with superior industrial real estate development knowledge is limited and not normally in service of Land Sellers. One exception are finished parcels that can be closed quickly. These are easier to value because there is current data. However, as the closing date moves further away from the contract date, risk and time has more room to enter to make valuations complicated.

Municipalities

While deal making is a black art, municipalities are equally a mystery. And at least in California, it’s the same all over the state. Entitlements, infrastructure, zoning, and environmental documents are a multi-year process. If the landowner wanted to sell his property tomorrow, he wouldn’t be able to except at a discount. Developers do not get as much recognition as they deserve for spending their own considerable resources and risk in the pursuit someone else’s property. If the Land Owner had the ability, they would entitle the property themselves. Entitlements on an infill site, while complicated, is easier in an established city. In a newly urbanizing area, basic planning documents, zoning and permitted uses may not have been established or what exists needs to be changed. Recent incorporation or annexation of previously unincorporated areas is one hindrance. Lack of adequate municipal budgets is another. In order to satisfy local jurisdictions, developers may need to do the planning themselves by submitting a Specific Plan and the studies that comprise CEQA Report.

Not only can’t cities afford to pay for planning, they can’t finance infrastructure either. To make up for the lack of funds, many cities promote the concept of either a team or consortium of neighboring landowners to create their own financing mechanism. Quite a challenge when you have a large discrepancy between levels of experience and wealth. City officials have no answers, particularly when it comes to water. This inability to bring in infrastructure is causing some developers to look at going it alone, in a creative fashion, until the infrastructure grid is built out.

Interim Uses

While not be condoned outright, cities have interim ordinances to allow for moderate degrees of cash flow to help carry the property. For instance, some municipalities will allow outside uses like truck parking or agriculture while permits are being processed. The continuation of non-conforming uses is another way to keep rent flowing while submitting development documents. Interim income can be very helpful to supplement carry costs, pay for entitlements, and stave off the imminent needs for money.

Zoning and Smaller Buildings

Zoning casts inequities. Most cities have a minimum of two industrial categories, heavy and light. The difference is big box industrial can go in the heavy zones. Light industrial has more restrictions because it’s closer to residential population. When the market is heavily weighted to large buildings, light industrial land is penalized. Because of economies of scale, building large buildings is much cheaper on a square foot basis. The bigger you build, the cheaper the rent. Cities have restricted building sizes in Light Industrial areas so land being equal, rents will be higher in Light Industrial, a competitive disadvantage that can only be adjusted by lower land prices. In addition, the market for smaller buildings has not proved itself viable so financing a “business park” development will be more costly than a single credit. Historically, Business Parks of multiple sizes have performed well, but until the lenders can see some reliable current data on small building rents, Light Industrial land will be penalized.

It’s obvious that smaller buildings have been ignored. You can see that on almost any market survey, bigger buildings overwhelm the list of new development. For smaller sizes, except for a few exceptions, you need to go back 10 years to find the most recent new construction. The biggest reason is finance. Institutional finance does not want small buildings – credit is weaker, it’s harder to deploy large quantities of investment dollars, and the market for small is just starting to recover. Unlike in previous recoveries when safe development would commence at 5% or 6% vacancy, we’re practically at 0% and there still hasn’t been much small development. Building smaller is more speculative and you don’t have AAA Credit. Without commercial banks taking their historic lead in the role as primary lender, there have been few financing alternatives. Extensive big development has occurred as a regional or multi-state logistics play. In the exurban markets, smaller development runs in tandem with roof tops to support local businesses. Bigger development is driven by broad economic considerations. Smaller development will follow trends in local economy. So far it’s the big distribution centers that have an economic purpose, but based on historically low vacancy, smaller building developments are on the way. Once the smaller buildings begin going up, we will be booming.

When to Sell

It would appear with all the complications to sell land, you’re better off keeping it, but that would be a mistake. Pricing and demand runs in distinct cycles and the difference between top and bottom is significant. Only a few years ago when nothing was selling, many people were making the case land contributed a negative value because rents were so low. The land had to be subsidized to make the numbers work. No wonder there was minimal construction for several years.

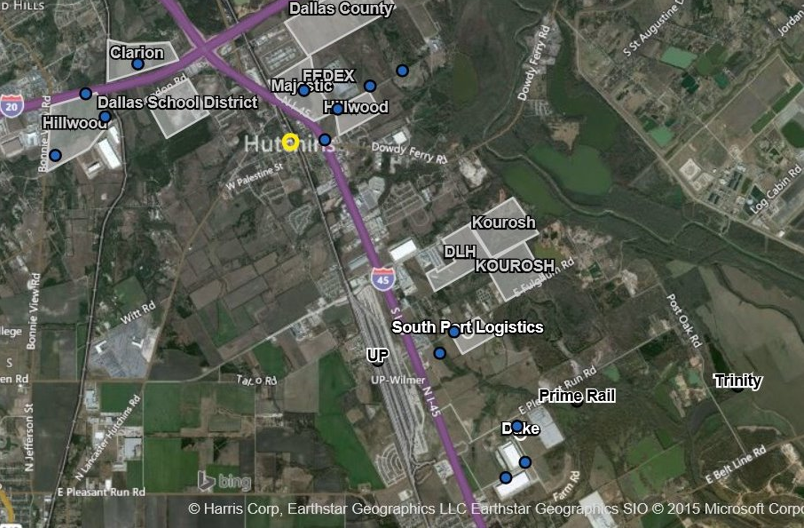

We’ve certainly come back from that period. Now prices and potential gains are exceeding all-time highs particularly in critical logistic locations. In basic portfolio allocation, when one asset becomes proportionally higher than all the others, it’s time to rebalance. Investors, corporations, and individuals all follow this logic. If you own industrial real estate, particularly land, in major markets like California, Bos-Wash Corridor, Texas Triangle, or South Florida, just to name a few, you should be getting an appraisal to see if the properties have outsized values and the assets can be redeployed more profitably.

With a market this hot, there are a lot of arbitrage opportunities. For instance, one popular arbitrage is selling the high priced property in Los Angeles and moving to the Inland Empire. The business can cash out, move to a less expensive area, have minimal disruptions, and locate to a more modern building closer to where employees live. This same opportunity exists by moving within the Inland Empire. Many companies will go out of state. Dairies and farms are leaving the Inland Empire to move to Central California and pocket the difference. Leasebacks have a role to play; the business can capture the real estate profit without even moving. Sometimes, it simply makes sense to take the money and shut down. All share one thing, they are cashing in on high priced real estate.

How Soon Can You Close?

After you’ve decided you can use the money, the second important question is how soon can the deal be closed? Theoretically, the developer does not want to carry the property more than one day than he has to. If he could, he would take title only for the few seconds before he can sell the project to an investor so he can make his profit without having to purchase the land. But that’s unrealistic. The more realistic scenario is to close before construction commences. Any time earlier, there is a deduction from the purchase price for risk and time. The farther in advance, the greater the deduction. This deduction can be calculated fairly precisely based on time and the cost of borrowing. Additional risk factors are added, for instance to account for market conditions. This is done separately by estimating how many months an empty building will need carry. The further out, the more deductions are taken. In other words, selling a property before its development time, normally equates to a lower land price. Besides price, timing is the Seller’s toughest decision because you don’t want to be too premature. On the other hand if you wait, the market can simply disappear.

Where the Profit Is

Developers keep two hurdle rates in mind. The first one is the rate the project needs in order to satisfy lenders and partners. Normally, it’s the spread between the loan and the total return. This is the profit margin. The second benchmark is the cap rate where the development can be sold, generally to the Fund Manager, but sometimes to a User. It’s here where a generous cash profit can be made. The first rate is to keep the project afloat. The second transaction is hopefully where the profit is. When developers say they build to a 7 and sell at a 5, that’s the profit on sale. One note of caution is when the developers start building for the sale market without any consideration to rental you are entering a higher level of speculation which is more sensitive to timing.

Occupier Buyer

One sure way to reduce risk is to have an Occupier in tow. They are Occupiers buying for themselves or acting as long term tenants. Occupiers provide an instant enhancement to credit, removes most of the risk, allows for better financing terms, and brings surety to closing. Normally, Occupiers come to the land owner by way of the developer. But that is beginning to change. Some occupiers with a large national footprint are looking to purchase and develop land themselves as a way to deploy their high level of real estate acumen and create another avenue to wealth. Timing is important. Occupiers need the space relatively quickly because they have a business to run. A few occupiers are willing to wait if there’s a good real estate deal to be had. Most however, need the space sooner and that explains the success in spec.

For lack of a better term, I’ll call them Occupier Buyers. Generally they come from the logistics industry and after negotiating deals around the country, they’ve come to realize the power of their occupancy to real estate returns. They are beginning to capture some of the real estate profit for themselves. Some have been buying for generations and have built up a tremendous real estate portfolio. Others see owning as deliberate corporate strategy to become large property holders creating a second line of business. We can see it clearly on the retail end with Macy’s Sears, and Hudson Bay. On the industrial side there are many, but less known companies in cold storage, truck terminals, wholesale and 3PL. Some occupiers have gone as far as creating their own REIT structures. The Occupier Buyers have similar capabilities than developers; there is no leasing risk; financing terms are better; and the proforma is tighter. If the landowner is fortunate enough to have an occupier in the deal whether as a Buyer or a Tenant, it generally works out better for all sides.

Traditionally, the developer connects the landowner to the occupier by developing the building, spec or build-to-suit. More recently Occupiers are taking a lead role in finding sites to maximize strategic location and extract more profit from the deal. The developer is then hired to complete the project. The occupier maintains control of the property to assure the lowest occupancy cost. At that time they can build up their separate real estate platform or sell when it is more advantageous. That’s an example of an occupier who understands the process.

In Summary: Here’s how to be a better seller.

Most Landowners are too removed from the market. They need help.

If possible, take the property through entitlement. Well worth the cost.

If you have the capability, stay all the way in.

Start making plans for infrastructure.

Plan to spend money.

Shop the Property.

Once Title changes, so does control.

Get the best – legal, accountant, broker, planner, architect, contractor, engineering.

Talk to the City often.

Know your property.

Expect a re-trade.

Keep your eyes open for a User-in-Tow.

Interim Uses

Don’t discount luck.

Jim: outstanding stuff. My hat’s off to you for elevating the level of discourse. You’re a true student of the market and process.