Funds are dominating the purchase of industrial real estate. Out of the top 40 Los Angeles industrial deals this year, the majority were purchased by funds. For off-market deals, funds purchased closer to 100% of properties that were quietly offered. The size of the fund can range from a $20 Billion public company dealing in billion dollar portfolios to a single operator with wealthy partners buying an old building to rehab. What unites all the funds is their view of real estate as an investment, not as a place to do business.

The predominance of funds has changed the business. Traditionally, the industrial business was directed by large international corporations and local businesses. Space Users drove the market. While tenants are still the cash flow drivers of every building, they have grown reticent due to economic conditions and want as little lease commitment as possible. Conversely, the funds have outsized influence on the industrial market because they bring endless amounts of financial firepower. The funds have vastly more money available than there is real estate to go around

Values today are underwritten by the quality of the income, potential of redevelopment, and investment attributes. This is in contrast to the Space Users where comps and functionality are paramount in decision making. Today, if a property can’t live up to investor needs, you’ve effectively eliminated more than half the buyers.

Funds also have a different character today. Funds once lived in a rarefied world of like-minded institutional investors who control substantial financial assets. They found property merely by being in the institutional league and through key relationships in markets that kept them close to the action. Now, the established funds and their newer colleagues have their own representatives in the field competing against each other for every opportunity they can find. Funds are more visible, transparent, and accessible than any time before

This shift in presence and visibility has led funds to subsume the local deals for themselves by either putting their own people in the field or creating strong partnerships with local operators. Many funds have simply incorporated the local operator role for themselves. The entrepreneurial character of funds has allowed them to fill a vast financial void. Funds provide liquidity while banks have become reluctant lenders. Funds are a destination for growing public and private growing pension plans. And real estate funds have been able to provide financial return in a world starved of yield.

The overwhelming presence of funds has led to enormous energy in uncovering opportunities in the off-market, particularly for the so-called value-added deals. That is, buildings that can be redeveloped to attract higher rents. The funds want turnaround candidates that were once the provenance of local developer/operators. The fund investors will compete for every 50,000 square foot building in the market even though their preference is for size. They will close all cash in lightning speed. And they will pay generous prices.

Each fund generally has an individual sweet spot where they can perform ahead of their colleagues For instance, some funds focus on big land developments for large warehouses and orient themselves for big sites. Self-Storage developers will screen for 3 acre parcels on major boulevards and near residential. If a fund like the income from multi-tenant, that’s what they will chase. Aerial maps, databases, personal commitment, and experienced brokers have made it standard practice to have a target list of properties. While an owner is thinking the fund is just making an offer on his property, he doesn’t realize there is not enough property to go around so the fund is offering on everything

Street level is competitive. While there are gems for those who do exhaustive searching, most buildings lack the attributes to get significant upside. Rents are generally in line with the market and the majority of buildings lack “added-value” potential. And just relying on rent growth is undependable. For instance, in B buildings, rents are the same today as they were 20 years ago but they cost more to run. While off-market is in vogue, there are substantial inventory limitations.

The combination of money abundance and limited opportunities leads to unsolicited offers. The funds have immense pressure to find deals because of promises they make to investors. Blind offers are legitimate because they are made under realistic assumptions. They are not necessarily low balls just because the property is not being offered for sale. More times than not, legitimate unsolicited offers create enough interest that some Sellers decide to create a mini auction. They ask their brokers to bring in the best 8 or 10 buyers to look at the property and make a bid. Instead of one big marketplace, there’s a continuous series of mini-auctions composed of fund buyers. The irony is an unsolicited offer often leads to a deal, but not for the one who first solicited. Meanwhile property is selling across markets by way of mini-auctions to a small selection of invited funds in the know.

A new dynamic is being created by the fund’s insatiable demand for property. The Seller doesn’t necessarily set the time for selling the property. Customarily, when a Seller wanted to sell, he would put the property on the market and look for offers. Now, in many cases the sequence has reversed and buyers are originating the action. Today, merely owning property means it’s potentially for sale.

The question of is timing is important. Most Sellers, especially those outside the investment world, would normally wait until the lease is over or the business is closed and then proceed with an orderly sale. But in a dynamic market like this one, waiting can be a timing mistake because the money is available now. Do you want to sell high or when it’s convenient? There’s no predicting the best time to sell. For example, land can go from hot to cold in a 6 month window and stay dormant for years.

Some Sellers, especially those with a trading background, will look at the unsolicited offers and ask a few questions. How is the timing to sell? How much would I pay in taxes? Is there anything else I can trade for with better income? How good is the price? Do I create a mini-auction and who do I invite? These tend to be owners that see property as a stepping stone to wealth creation.

Individual property owners are at a distinct disadvantage when facing a fund because they lack market knowledge. Capital markets are precise in valuation and there is an exact price based on the age of the building, the character of the rent and the usefulness of the structure. Those who negotiate everyday understand the nuances of location, usefulness, and building quality. Funds rely on individual experience, 3rd party industry resources, and demands of capital. Funds know values exactly.

Money changes everything including the rules of buying and selling. The Seller no longer dictates the time of engagement but with the right defense, Sellers can set the rules. Unsolicited offers from real estate funds have become the new calling card. While unsolicited offers are often criticized as a ploy to get a low price from an unsuspecting seller, it is a simple and practical method to get the money out. For the opportunity-minded, an off-market proposal with the right pricing can be the best your best offer.

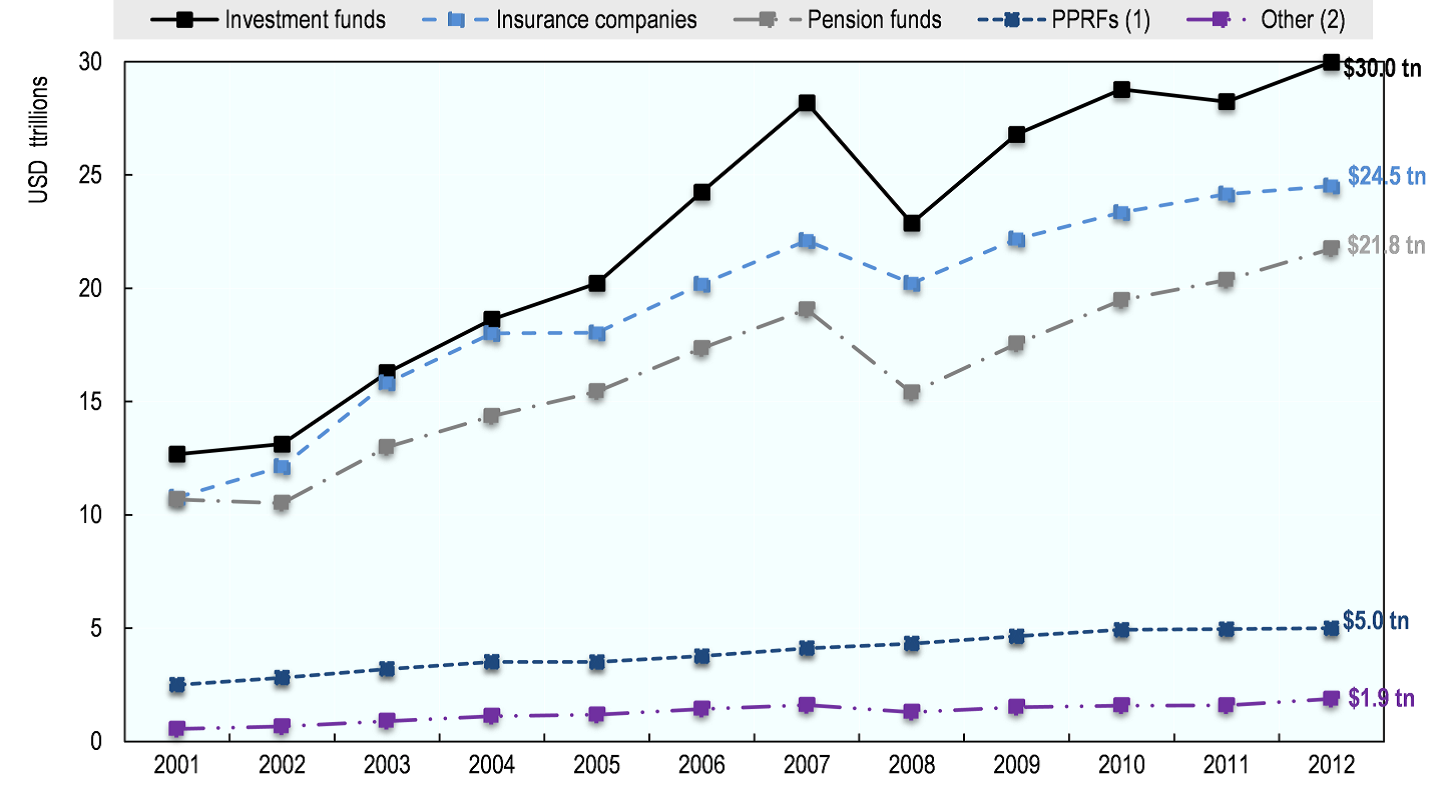

(Figure 1. Total assets by type of institutional investor in the OECD, 2001-2012)