Environmental Justice and the CalEnviroScreen

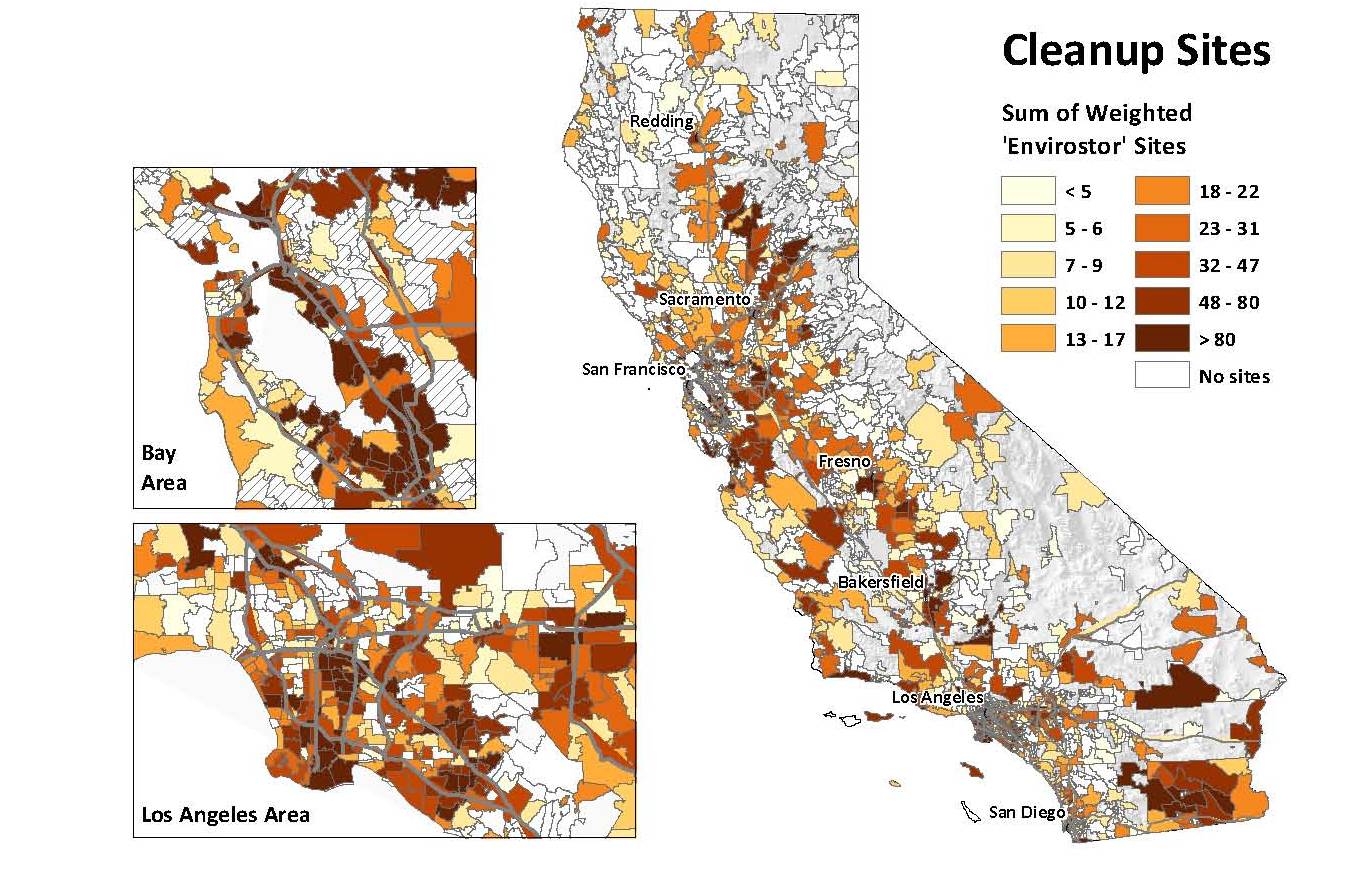

Soon there will be a new and very comprehensive tool to assess communities, developments and industrial projects in the State of California. The name of this tool is the CalEnviroScreen (CES) and it is a compendium of socioeconomic, health, and environmental resources that is publicly available for the first time in one location. One controversial use of the CES is to judge a project’s potential harm or assistance it will provide to an already stressed community. While the CES provides critical information, if not used properly, it can easily impede new development to communities in need.

Continue reading “Environmental Justice and the CalEnviroScreen”