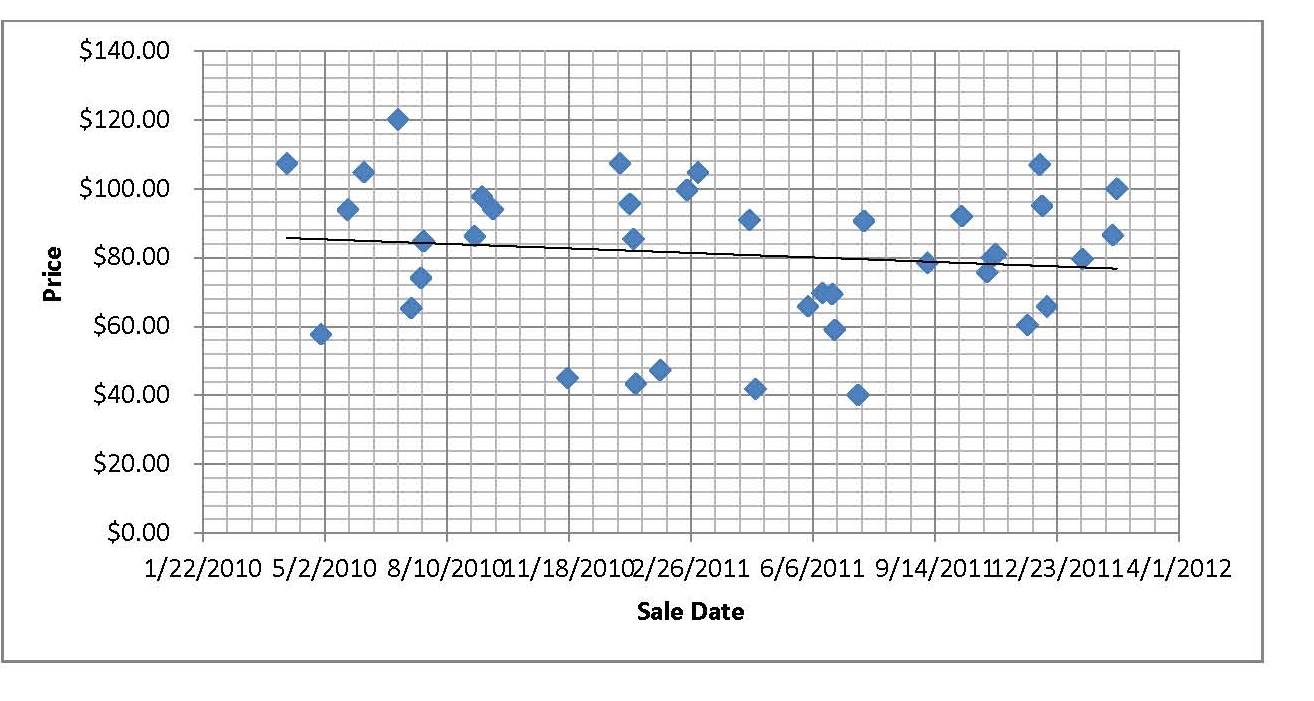

We looked at building prices over the past two years. We put in everything we could find – not adjusting for size or quality. From the beginning of 2010 until today we found prices about the same and slightly leveling down. As you can see for yourself on the above scatter chart, the average Gardena building is in the $80.00 range. It’s been dropping $5.00 or so over the period. With all the news regarding an increase in manufacturing and better employment numbers, so far these trends have not increased industrial building prices.

On the transactional level, there is much more demand to purchase than to lease. Buildings priced for sale using the above matrix are selling fairly fast. Buildings for lease under this same pricing scheme have a lot less interest. The momentum to purchase is caused by two things. There is enormous monetary stimulus and low interest rates. That means for those who qualify, there is plenty of financing available. On the high end, investment funds can purchase for all cash. On the User level, the SBA is making low down payment loans very possible. I wonder what would happen to pricing if money supply was at a more “normal” level?

The other very prevalent trend is the repatriation of US dollars by way of Asian Buyers. Export businesses in Asia are returning US import dollars by way of asset purchases. In terms of lending, there is a big difference between US and Asian Banks. The latter seem to be in better condition to support their customer’s demands. Asian investment is not new, but since the Great Recession, it has hit a more noticeable level.

One other trend is worth noting. Since the beginning of this year, developer land purchases and spec construction has started to take hold. These are not distressed land purchases. In fact mid-$20’s per foot is very reasonable pricing. But this activity is far from a frenzy. Some of the new construction is from projects that have been mothballed over the past few years. A few of the new land purchases are being held for build-to-suit. However, by the end of this year there will be several brand new constructed buildings on the market.

In general, and similar to the trend chart, it is still a wobbly market. There is no consistency and mediocre offerings languish for long periods of time. Many owners are still making the same mistakes with excessive expectations. My personal experience is I will have a good period, then nothing for a long while. For the first time in my career, I am doing as much business out-of-state, as I am in Los Angeles. In summary, compared to the darkest part of the recession, we are in a better place today. And I can live on that…..