Aerotropolis – Book Review

Aerotropolis – The Way We’ll Live Next

By John D. Kasarda and Greg Lindsay

Farar, Straus and Giroux 2011

Aerotropolis – The Way We’ll Live Next

By John D. Kasarda and Greg Lindsay

Farar, Straus and Giroux 2011

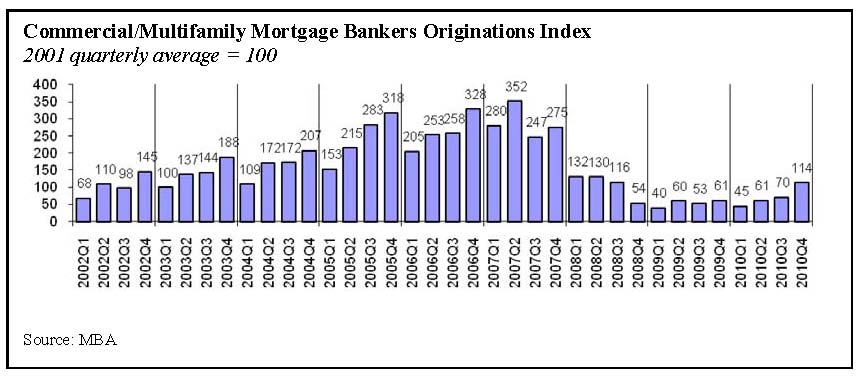

The first signs of a market collapse in commercial real estate began in August of 2007. Home builders started to forfeit large deposits on land deals. The rest of that year, other developers pulled out of deals until it was impossible to sell land to private developers. Many people missed that signal because User building sales were still climbing and continued until the Lehman collapse one year later.

Continue reading “SURVIVING THE MARKET BREAKDOWN – 4 YEARS LATER”