A few years into the Los Angeles commercial real estate recession and some things are clear. Good deals are limited. Distress never hit the street. There’s an evident turn around but most people aren’t recovered. And the smart money is still cautious – for instance, no vacancy risk.

I see two types of business trajectories. Companies that have overcome the worst, solved their problems and are thriving. At the same time, there are companies that already had bad models, got slammed during the recession, and still are trying to find a way out. The spread between the two gets wider every day.

On the Positive Side

- Internationally focused companies are making sales. While not a new phenomenon, many of these private firms are making so much cash they need to recycle their earnings into real estate. When making location decisions they often have different cities in mind. Luckily, on a strategic level, Los Angeles is often on the list.

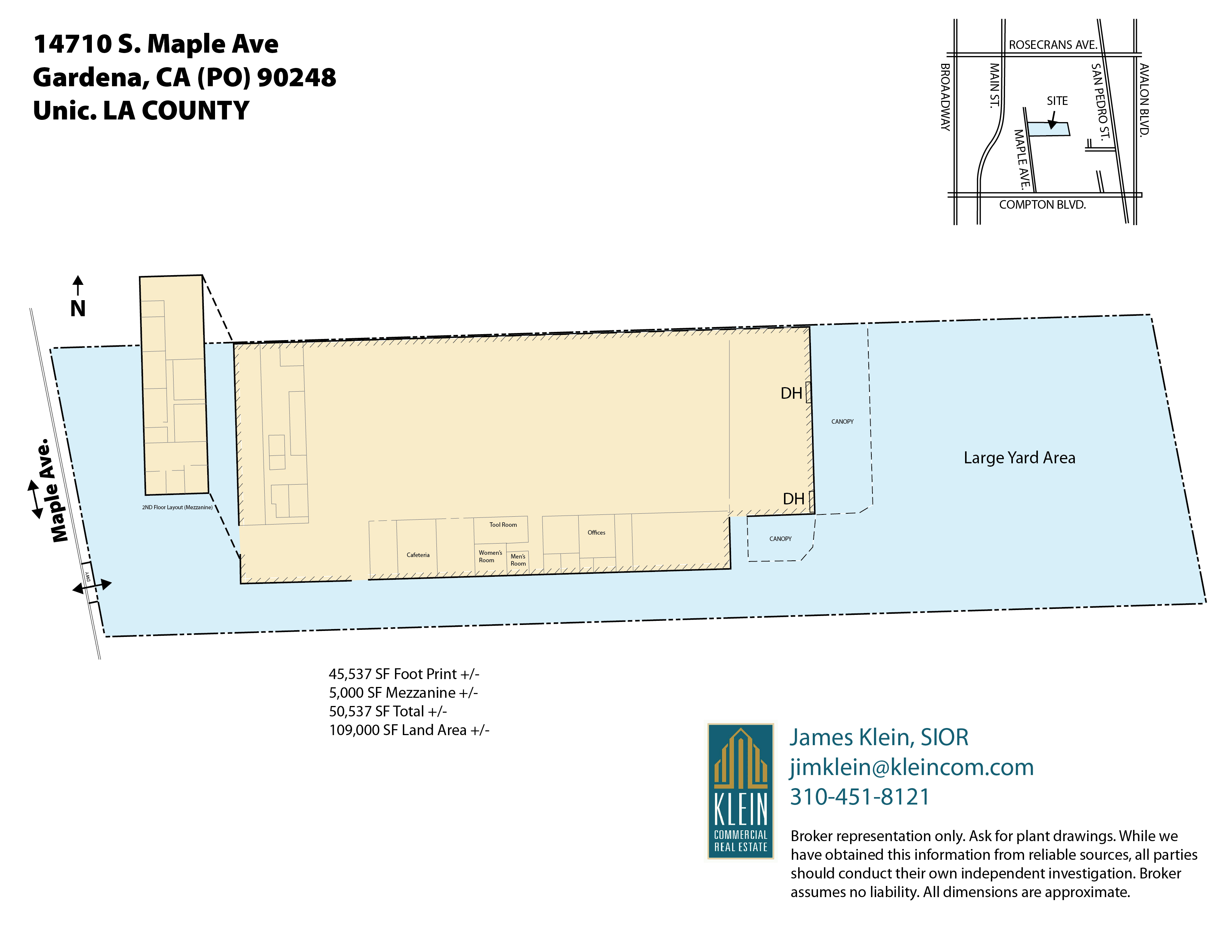

- In terms of product, there are some requirements that can’t be satisfied with current market offerings. The wish list includes 40′ ceilings, a port orientation, very large yard areas and rail service. This is an opportunity for landholders to build to suit for credit worthy companies.

- Developers are starting to reconsider stalled projects. Many land sites were shut down because a lack of financing and tenants. Now with money trickling back, developers for these sites are gauging market demand. Some have restarted construction. Others are examining old development plans with a new eye on what is feasible today.

- Developers who have access to state bonds, federal stimulus dollars or CRA funds are buying and building. Generally, it’s the same two dozen developers, state and nationwide, that are competent and connected. While billions of dollars in subsidies may vanish from redevelopment agencies, other subsidies will take their place. Simply, it takes public money to realize the political vision that is manifest by physical projects.

- The most hopeful sign today is the actions of Tenants facing a lease termination. Over the past few years, many Tenants were satisfied with short term renewals at their current location to avoid making a bad decision. Now with the worst behind us, some users are willing to venture into longer term decisions at new buildings especially while pricing is relatively low.

The Negatives

- Actual done deals are still rare. Market conditions are slow. There is no momentum and no adrenalin rush from closing deals. Much of the new confidence comes from hope rather than substance.

- The typical mid market industrial building of 50,000 square feet is renting for $.35 gross. The same rent of 20 years ago in real terms. Tenant quality is weak. And if you use a realistic cap rate, the sale price will be below most loan balances. We may be seeing the last of these give-away rents, but we’ll only know in hindsight.

- Many landlords complain that tenants are still having trouble paying rent and they have no alternative unless they want to risk a long vacancy and invest money in the building for refurbishment. So far demand is not there to take the risk.

- Some properties are worth almost nothing and many have negative value. This is particularly true for land and old manufacturing properties that need demolition, clean up, and entitlements. At one time these properties were extremely desirable for redevelopment and they would competitively trade off market. Now leasing, environmental, and municipal risks greatly outweigh the speculative return. One day, the broad chorus will be, “why didn’t I buy when I had the chance?”

- At a recent lunch with broker friends, mostly on the local tenant and owner end, there was agreement that we are hearing of deals but no one is making any of them. The deals we could point to were done for fairly low fees and were split a number of ways. So those of us living on commission are still in very lean times.

Quality Divergence

Just as business is running on two different tracks so is the business of real estate. There is a big difference between institutional and non-institutional real estate.

- Funds have reestablished their intention to purchase property for well leased, quality buildings. Many use an actuarial, macro investment model to justify their purchases. Their reason to purchase should not be confused with the ordinary market. With pricing at the bottom and 10 year treasuries at 3.7%, return rates of 6% are fairly easy to justify in comparison to other investment alternatives. Institutional properties have not seen as much of a price decline as lower quality or vacant properties. Rising interest rates may change the picture but many anticipate rents will move in tandem.

- In the User market of non-institutional real estate, the primary benchmark is rental rates, not the broad spectrum of investment alternatives. Here you have the same gap between user and investor pricing that always exists. While prices are down, so are rents. But even with the poor sales volume, user prices are still 20% above what an investor will pay. As it turns out, except for a few rare circumstances, distressed properties have not had a large impact on industrial Los Angeles. Yes there are foreclosures and non-performing developments, but low short term interest rates and bailouts have prevented the blood bath many were predicting. There is also a very large, very opaque secondary market of discounted notes that is relieving pressure. In other words, most users should not delay their expansion plans waiting for an absolute bargain purchase.

- Since institutions and funds are competing for quality, seasoned properties, it leaves the vast non-institutional market for other investors. It is a picker’s market just as in the good times because searching for good buys is a full time profession. Buyers with a discerning eye will look for buildings on major boulevards, that have large yards, could be divided, re-zoned, or are just plain cheap. Those with good brokerage contacts or leasing skills will try to pre-rent. The hardest thing is to take action and speculate that rents will rise, prices go up, and vacancies will be limited. I’ve missed a lot of good deals that were staring me in the face because of hesitation. From a risk perspective, it should be comforting that in this part of the cycle, a lot of the bad news is behind us.

Changes in the Real Estate Business

Since deal flow has been in short supply, most brokers need to increase the quantity of leads. There has been a large investment in cold calling programs, deal searching, social media, and presentation making. There’s a corollary in the Buyer world as many Investors find they can go it alone with less brokerage help. This investment in the process of the business will create have and have-nots as business improves.

For example, every brokerage team is trying to create their own Bloomberg machine for real estate deal making. They want a super charged marketing program with automatic lead generation and customer self service. Think of a big pipe stuffed with data where computing power creates a backbone to properties, users, investors, and market knowledge on a global basis. You simply flip a switch and out comes a fortune in real estate deals. It is a bit fantastical, but certainly on the right track.

Other industries have created such a platform in areas such as energy, consumer products, and of course, finance. Even the real estate industry has varied pieces like a national property multiple for listings, a central list of institutional buyers, or services that gather fundamental data on commercial real estate. Some shops, on a targeted basis, have focused on large NNN properties, major investment properties, or large distribution tenants. Look at the companies purchasing billions of dollars in commercial real estate debt. They need powerful systems to analyze markets and sell thousands of properties.

Because we have been through such a low point in the business many brokers have shifted away from a more personal form of interaction to one that is driven by data centers and CRM programs to service their customers and generate sales. There is no question that a good relationship is the most valuable type of contact, but in its absence, many brokers, out of necessity, have opted for the volume. Once the varied elements have been painfully integrated, there won’t be any going back.

On balance, I am optimistic. All we need is the proof…..