Tenant decision making has radically changed since the Great Recession. The combination of low interest rates and falling prices mean that mortgage payments are the same as or less than rent. This has been a fairly rare occurrence over my 30-year career. Tenants with established histories are finding some great bargains. Even companies that may have difficulty obtaining loans and lack large down payments can team with sophisticated investors to solve many financing hurdles.

Searching for deals was once the domain of shrewd real estate operators, but uncertainty, credit and legacy problems have sidelined many of the aggressive buyers. Because of vacancy risk, the value of a tenant is the critical difference in closing deals. With the threat of slowing growth, a year vacancy can destroy a proforma. In other words tenants have become the only viable buyer for many properties.

Before the recession, industrial real estate was marketed on an efficiency ranking. Physical attributes such as maximizing throughput with loading doors, yard depths, ceiling heights, and access was the primary criteria for many tenants. Many developers and users strove to create the the best designed warehouses for maximum velocity. The supreme example is a cross-dock building with large side yards for container storage. Metrics included number of loading doors per square foot and cubic storage capacity. While tenants will always want functional properties, many will sacrifice the most efficient features for more affordable occupancy costs. This is a significant change wrought by the Great Recession. A lower rent for a less efficient building is an outspoken preference.

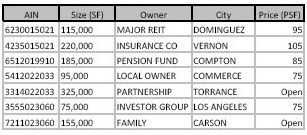

The desire to reduce costs coupled with an eye on profiting from property has changed the dialogue with tenants. Not only is there a wide selection of choices, but many tenants are starting to probe more deeply. They want to know when the property was acquired and what are the characteristics of the property owner. If the building was purchased in the boom, then price flexibility will be limited until the bank takes over. Moms and Pops tend to be better Sellers than institutions, although not necessarily true in every instance. Certain areas also tend to be better long term investments. Cities with a history of good governance and pockets of institutional ownership are a couple examples of preference.

Over the years, some very smart buyers have followed a different acquisition strategy that bears some reflection. By luck or by skill they have located their businesses in locations that receive preferential zoning entitlements. These properties could be in high density commercial corridors, near transit hubs, or for other reason are more valuable than the existing improvements merit. In a growing city like Los Angeles well located properties go through periods of excessive valuations. While we may be some time from development activity, if a user can satisfactorily occupy an older, well-located property, upside will drop in his lap.

In the first part of this year, there have been some very good purchases. I have seen prices as low as $45.00 for older properties that need work, but mid $50’s to mid $60’s for rather decent buildings. One of the largest, but older industrial buildings in the County sold quietly this year in the mid-$40’s. This is not to say deals are easy to find, but with declining economic news, we are closer to the beginning than the end of the deal wave.