If there is one major driver that supports Los Angeles Industrial real estate, it is counted by container shipments that enter the Ports of Los Angeles and Long Beach. These shipments are singularly responsible for the development and leasing of large blocks of high-cube industrial space. When goods are flooding into the ports, industrial building development booms throughout Southern California.

Every major landlord and developer points to the Harbor to justify their building growth plans. Now with container volumes on the decline (although from a very high level), longer space absorption will become a significant factor in analyzing future planning. It will just take longer to lease those buildings.

New buildings will continue to be attractive as companies leave older “B” and “C” warehouses. There is always a migration to better product when leasing conditions begin to soften. Older and obsolete buildings suffer, but new developments will also miss their proforma targets. Unfortunately, for now, manufacturing is not much of a substitute as a major source of replacement tenants.

All industrial real estate practitioners will continue to keep their eye on import flows along with consumer spending and cash-out mortgage refinancing. This linkage has given us a great market. Now we’ll be paying closer attention to these important indicators as we look to the future.

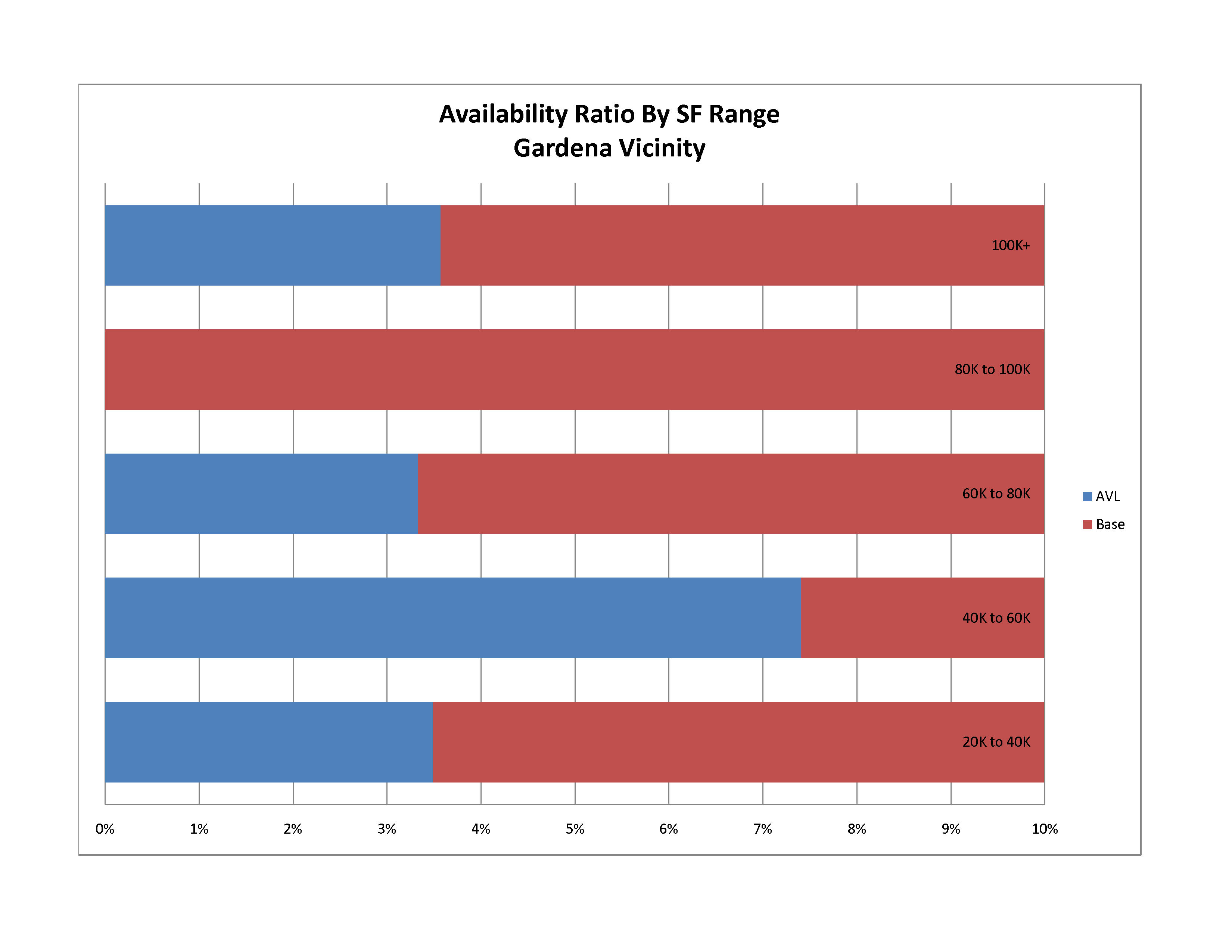

Many of the leading brokerage companies and economic forecasters are currently quoting vacancy rates of industrial space at 1.5%. I’m not so sure it’s still true. I looked at a small sub-market where I have had some experience over the past 20 years and have found availability rates are higher than many may think.

Firstly, Gardena is a fairly central market to greater Los Angeles. It’s located approximately 15 or so miles from Downtown Los Angeles, Beverly Hills, Palos Verdes, and the Major Ports of Los Angeles and Long Beach. The Gardena vicinity also includes parts of Los Angeles City and unincorporated Los Angeles. This location is central to the Los Angeles economy. Buildings generally date from the 1960’s to 1980’s.

I have found an overall availability rate of 4.7% from a base of approximately 17,500,000 square feet. From the 800,000 square feet now being marketed, a couple of size ranges are increasing. While we are still at a fairly benign rate of availability, and with only 18 or so buildings being offered, these are not alarming statistics. However, as your doctor may say, well worth monitoring, especially in the range of 40,000 sf to 60,000 sf.

We’ll be looking at some other areas throughout Los Angeles to see where vacancy rates are headed. So far dire financial news has not struck too badly at industrial real estate, but most of the optimists are having trouble raising funds.

PDF of Availability Stats. Underlying data also available.