What I learned in Scottsdale

A brief summary of the Industrial Deal Makers Panel follows below:

A brief summary of the Industrial Deal Makers Panel follows below:

Here is a preview of the panel we’ll be having in Scottsdale this week. I’ll post notes and the audio as soon as it is ready. All slides are in pdf format. klein SIOR presentation

As I was driving around Dallas last month looking at Big Industrial there was news that Amazon was about to offer-one hour delivery to selected zip codes. Dallas Morning News has a good story with the reasoning behind it. The important part for real estate location is how Amazon and others like them pick their zip codes for the roll out of the new service. Density is the primary factor. If you are 40 minutes away from the densest areas with multi-story housing, you can’t make too big a mistake. Other location criteria is still experimental, as-is many of the theories behind ecommerce location. If one-day service is successful, there will be many corollary locations in other cities. Real estate people like myself are watching the ecommerce evolution carefully.

Continue reading “ONE-HOUR WAREHOUSE”

The history of Gardena matches the development of Southern California with a couple of notable exceptions. From Spanish land grant, to small ranchos, a strong period of industrial growth, to today’s reliance on international trade. The unusual Japanese and Asian influence gives Gardena its unique characteristic, mostly to the positive because of the industrious nature of the Japanese culture. Interestingly, there were two waves of Japanese immigration. One in the early 1900’s as farm labor and again in the 1980’s with the arrival of the global-scale Japanese corporations. The Gardena development plan of mostly smaller industrial property is also significant.

Continue reading “Dealin’ In Gardena”

2014 ended on a strong note at year end. All my listings are either leased or sold and it confirms the space shortage that is looming throughout Los Angeles. Tenants should be looking six months prior to lease expiration and be prepared to pay double rent as soon as they find a space they like. Not only has there been very limited new construction over the past several years, but high sale prices have taken a lot of buildings off the lease market. This has put upward pressure on lease rates for functional distribution type warehouses. Most new developments are exceeding their proformas with deals being struck during construction, especially on the sale side. The predominance of cash buyers, both from foreign investors and funds is dramatic even as the march of higher prices and lower yields continue.

I’ve uploaded my presentation for the Nashville conference in a PDF document. The focus is on industrial land development throughout the United States. Everything goes better with good programming and I hope to demonstrate how the MAPP program is helping me with land developers. I have some other thoughts I will be sharing with you shortly about developing a trading platform for on and off market industrial. In the meantime, please review the attached and contact me with any questions or collaborative enterprises. Nashville Land Development Program

(1).jpg)

Where The Land Deals Are

On April 23rd, SIOR held a Land Development Meeting in Las Vegas. We were fortunate to have four leading industrial building developers tell us about industrial land deals today. The comments have been updated to the publication date of this article.

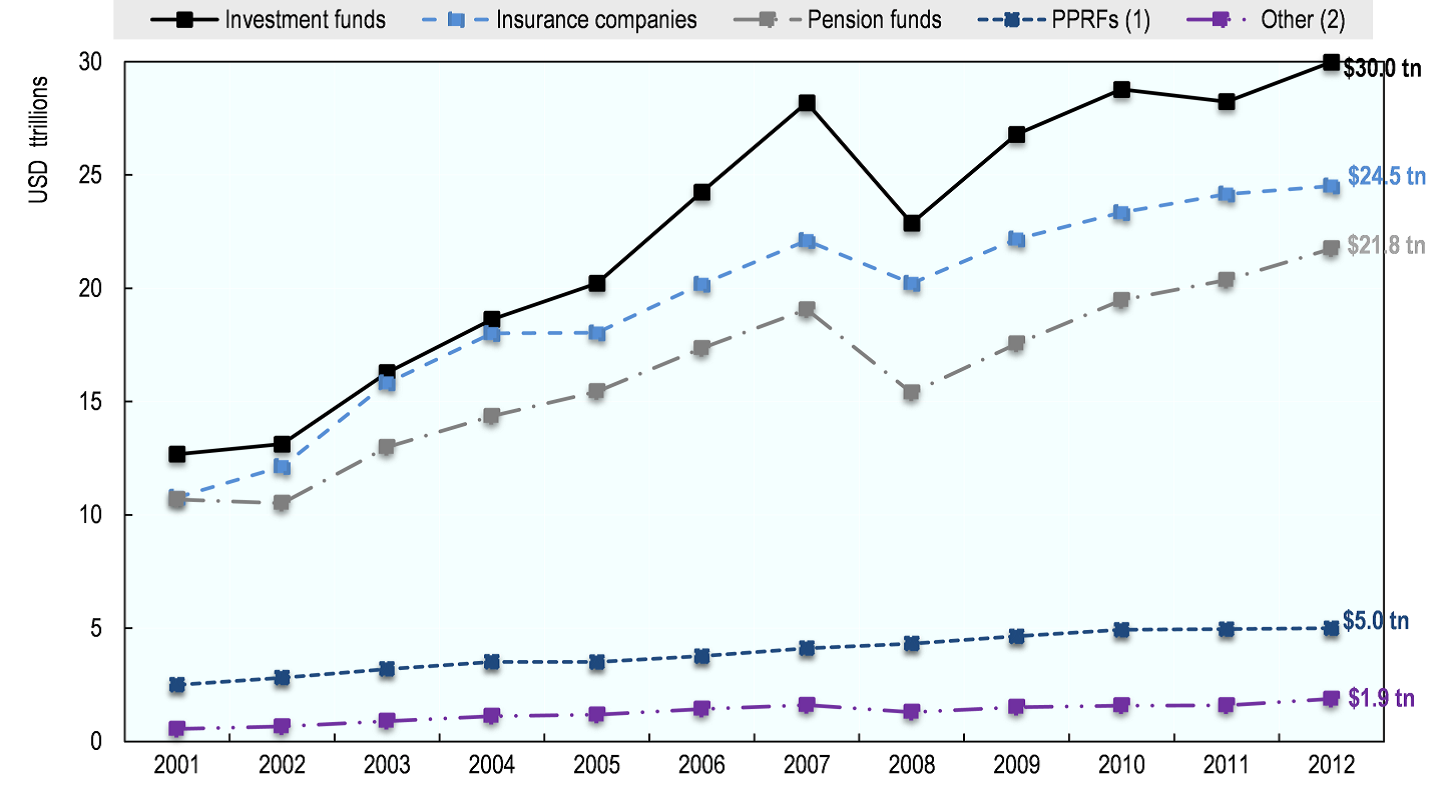

Funds are dominating the purchase of industrial real estate. Out of the top 40 Los Angeles industrial deals this year, the majority were purchased by funds. For off-market deals, funds purchased closer to 100% of properties that were quietly offered. The size of the fund can range from a $20 Billion public company dealing in billion dollar portfolios to a single operator with wealthy partners buying an old building to rehab. What unites all the funds is their view of real estate as an investment, not as a place to do business.

Continue reading “Funds Continue To Dominate Purchasing Activity”

We’re starting off the year with good listings including a 58,000 SF building in Paramount (lease), a 7500 SF Building in Gardena (sale), a 9 acre development site in Compton (sale), and a 2 Acre Truck Yard in Gardena (lease). I also have deals working in Riverside, CA; Houston, TX; Long Island, NY and of course, Gardena, CA.

Continue reading “What’s New at Klein Commercial – March 2014”

In Los Angeles, older buildings continue to be valued unlike in many other post-industrial cities. Although these buildings have lower ceilings, poor loading, and limited parking, there have many types of occupants. The main advantages to older buildings are their low rents and central locations. One significant downside is since older buildings compete on low rents, owners can’t afford a lot of improvements. This condition creates blight and despite good occupancy rates, neighborhoods decline. Taxes and planning laws exacerbate the situation.