How Is Industrial Real Estate Today?

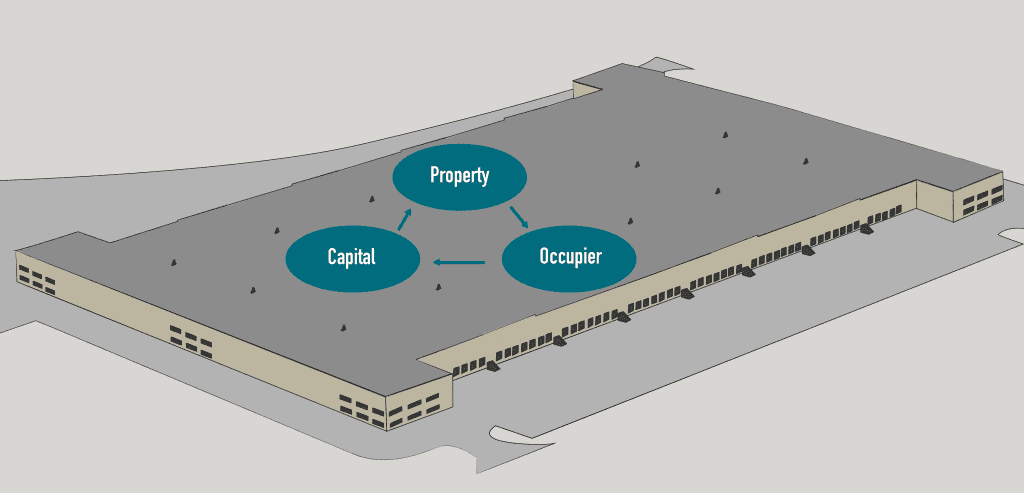

Industrial real estate is a diverse business that includes Investment funds, developers, private/family owners, corporations, occupiers, and a mix of product types and industries. Industrial buildings are in every community and are the source of employment, production, distribution, and wealth for many. The nation’s economic health rides on the success of industrial real estate.

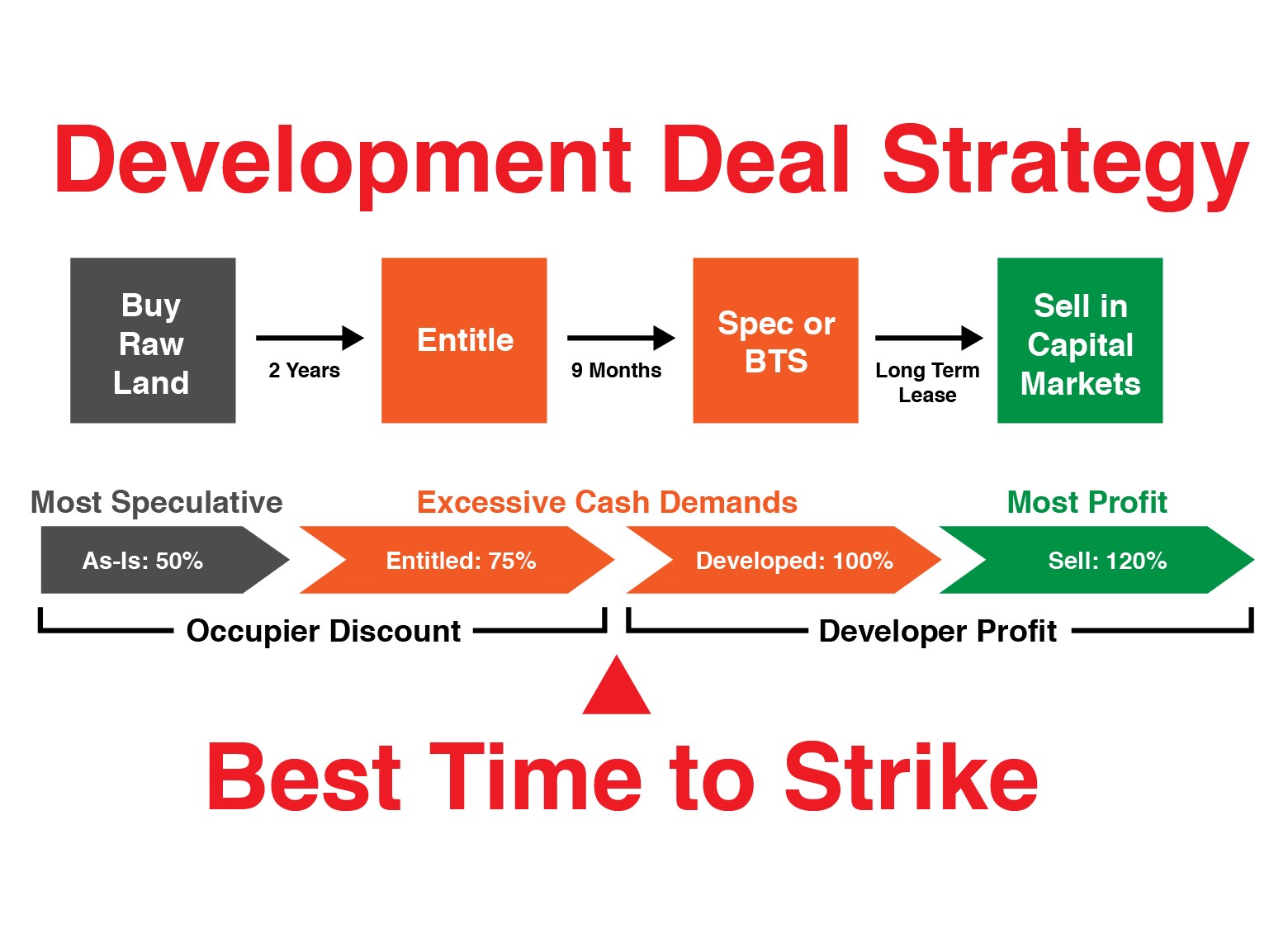

There are several factors that are driving deals today. Broadly, these include Interest Rate Policy, US Industrial Strategy, and Local Municipal Governance. Everyone is affected differently. For example, higher interest rates are never good for real estate, though they affect sales more than leases; sale transactions are interest rate sensitive while leasing is supply and demand based. As an experienced broker, we use detailed knowledge, market analytics, and long-standing relationships to help you in making the best decision.

Continue reading “How Is Industrial Real Estate Today?”

.jpg)

.jpg)