Four Current Forces of the Industrial Real Estate Business

The current robustness in industrial real estate markets obscures many forces that can balance and protect your investment and location decisions. Technology, Monetary Policy, Political Risk, and Space Transparency are important factors that provide support during good times and bad.

Continue reading “Four Current Forces of the Industrial Real Estate Business”

Digital Transformation Of The Industrial Broker

Here is the reading/resource list for the session in Austin entitled, Digital Transformation Of The Industrial Broker

reading list

Race for Space – The New Dynamism

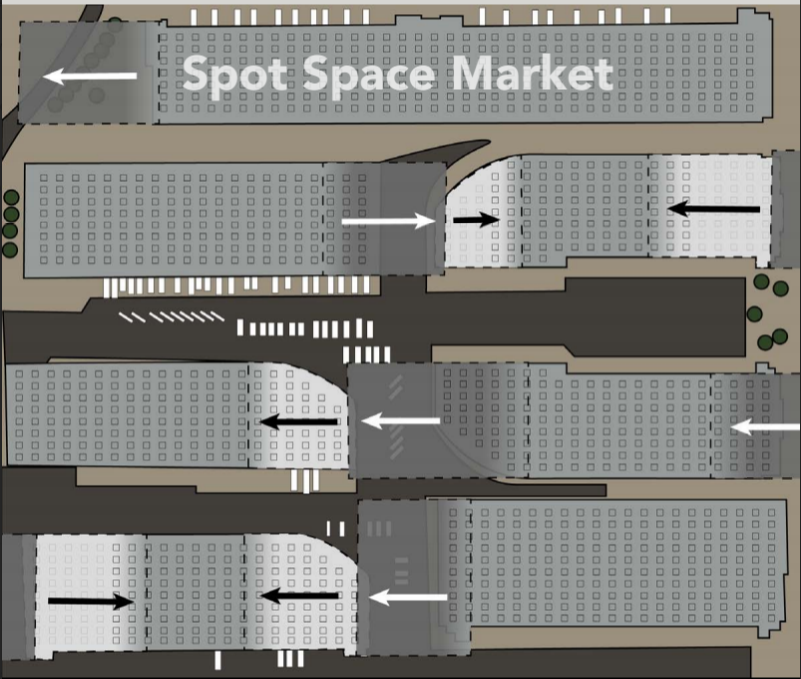

Dynamic pricing is becoming a greater influence on space leasing and building sales. By dynamism, I mean fluctuating rents separate from conventional underwriting. A “spot market” is emerging to satisfy demand for smaller, flexible, and elastic spaces. Many examples include Truck Yards, Warehouse Sharing, Creative, Cannabis, and other categories of sub-space where “street rents” are disconnected from contract rents. WeWork and Amazon are two primary examples that contract with the Landlord at one rent, and lease out space bits at higher rents. Public Warehouses, Self-Storage, Swap Meets, Studios and Truck Yards operate along the same model by collecting additional rent by offering “alternative occupancies” with varying degrees of added services. The revolution is any building can be pieced out especially with easily acquired technology that can create “smart” buildings for automation, surveillance, and access.

Continue reading “Race for Space – The New Dynamism”

Winter News 2016 – Industrial Real Estate Profits

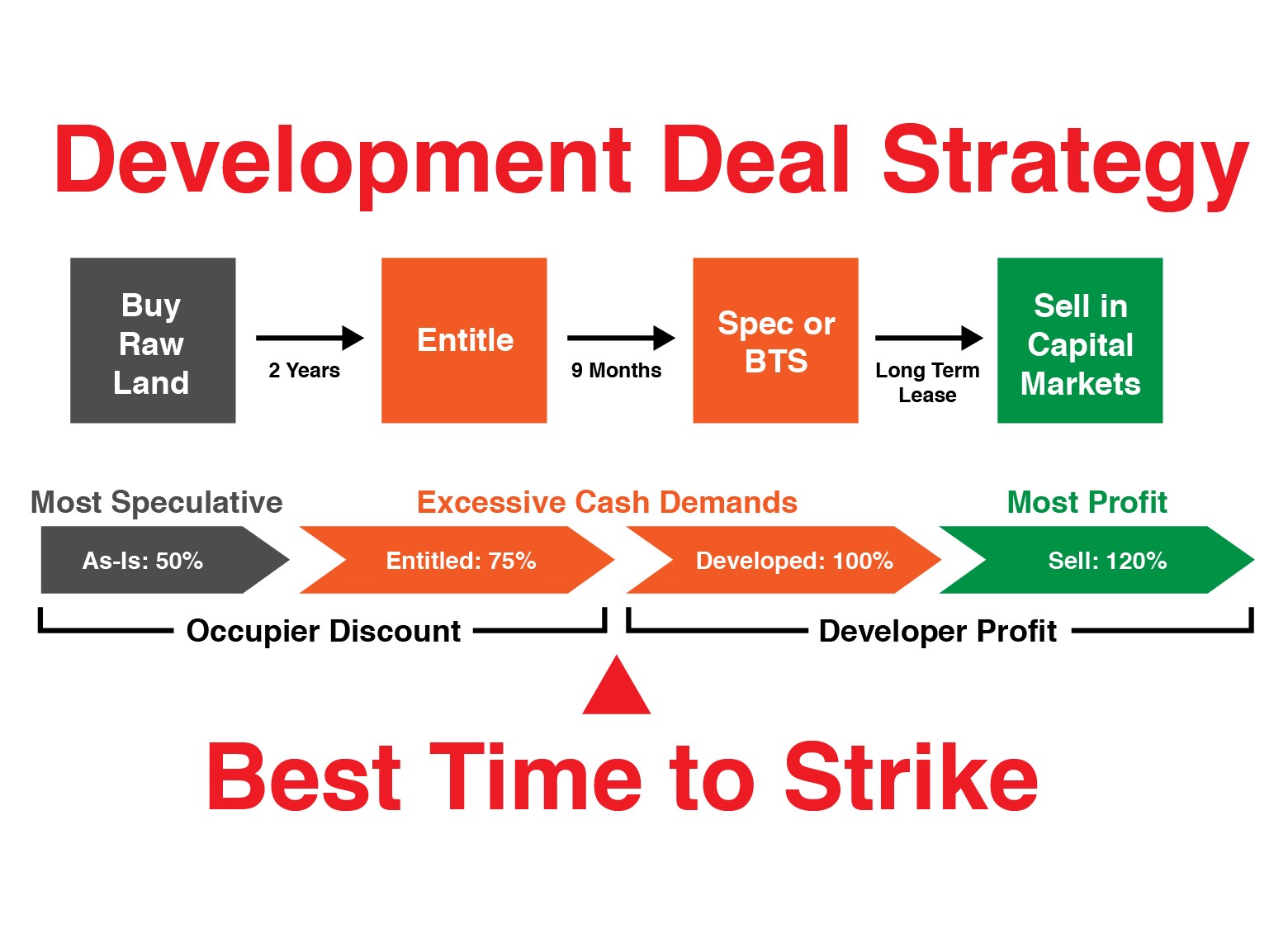

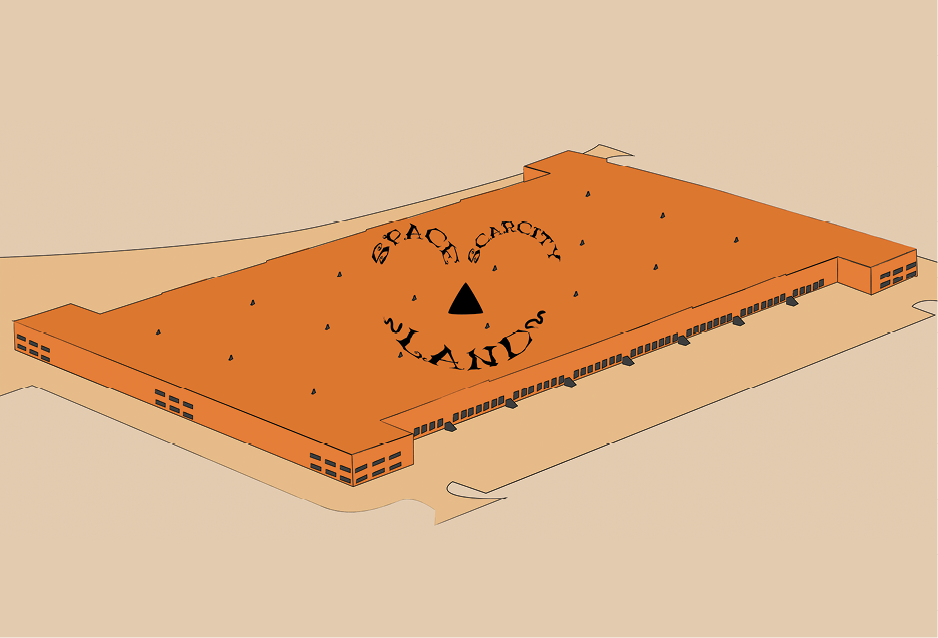

The current cycle is being propelled by three major conditions: Space Scarcity, Capital Markets Pressure and Rent Surge. Market dynamics are still very favorable for development and will only be disrupted if demand begins to weaken. Otherwise, strong fundamentals are the prevalent condition in most major U.S. markets.

Continue reading “Winter News 2016 – Industrial Real Estate Profits”

Notes From the 2015 SIOR Fall Conference in Chicago

Here are a few notes from the SIOR Fall Convention 2015 that was held in Chicago this past weekend, October 8-10.

Continue reading “Notes From the 2015 SIOR Fall Conference in Chicago”

Looking at US Industrial with the US Cluster Mapping Project

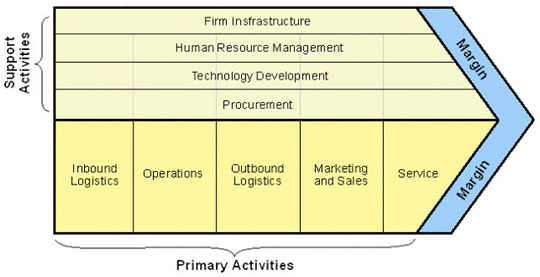

The Cluster Mapping Project (CMP) was pioneered by Michael E Porter of Harvard University. He is just as well known for his works on Competitive Advantage. His work is a necessary foundation for US Industry and business organizations. I reprint his Value Chain diagram below for company diagnostics, which has been repurposed to examine the competitiveness of regions. To understand the implications of location and clustering, you can read an article Professor Porter published in 1995 about the strategic location of inner cities which is just as relevant today.

Continue reading “Looking at US Industrial with the US Cluster Mapping Project”

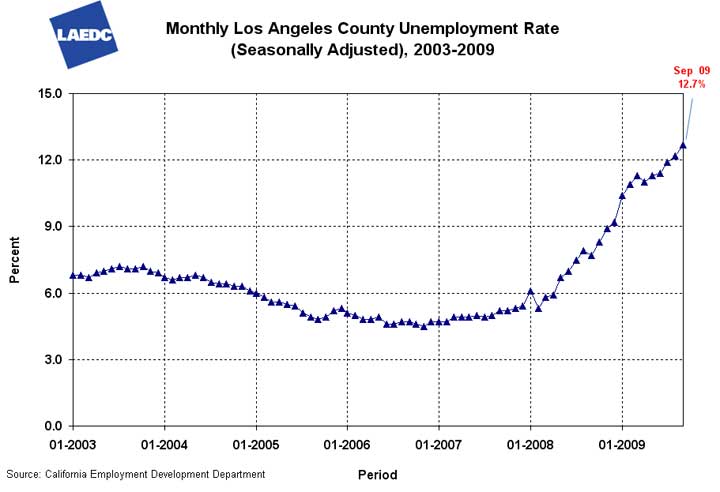

Economic Development in Greater Los Angeles

More so than ever before, cities are vying for companies that create jobs. There’s the policy aspect that favors clean and green jobs. Then there’s the backroom bargaining that favors successful outcomes. Companies that can offer employment would do well to study some of the recent newsworthy examples. They include the failed attempt by Los Angeles to attract AnseldoBreda, local jostling to snare Tesla Motors, competition for Eli Broad’s museum, Los Angeles Stadium in the City of Industry, and the smaller manufacturing deals coming through the CRA of Los Angeles. Each one is fairly lucrative to the company and does not necessarily fit any set model. They are similar to the large retailers, like Costco or Walmart, who were able to negotiate attractive packages for redevelopment funds, property tax breaks, and property development benefits. I haven’t seen any studies if these retail developments met city economic expectations, but certainly the recent raise in sales tax makes up any marginal differences. It pays to understand the multitude of incentives available from local, state and national agencies.

Continue reading “Economic Development in Greater Los Angeles”

The Year Ahead – 2010

General Sentiment

To judge the health of the industrial market, I rely on activity reports from fellow brokers. Across the board, its been obviously weak. Most of my peers are squeaking out a living from short term leases and renewals. Sales and investments are moribund. There’s a bit of government support and stimulus work for those in the pipeline, but not enough to have a broad impact. Many agents have left the business. Most of my broker friends anticipate the same for 2010. We may be nearing the bottom of the cycle, but most sellers and banks are not willing to accept the greatly reduced prices.

Finding Deals In Foreclosure Land

Foreclosure pricing has set the tone in the residential market. While we remain in Foreclosure Land, everyone wants a bargain. This way of thinking bleeds to what was once the “normal functioning” market. Many are anticipating the same will happen in the commercial area. But whether in good markets or bad, the same thing holds true. It’s hard finding deals and it takes ingenuity to make them work. Now more than ever, a tenant is the critical ingredient in almost every purchase.

Continue reading “Finding Deals In Foreclosure Land”

.jpg)